In the world of finance and investing, staying informed and proactive is key to success. Taking a closer look at the current market conditions can provide valuable insights for navigating your investments effectively. As we embark on the week ahead, it is important to keep an eye on key levels and trends to make informed decisions.

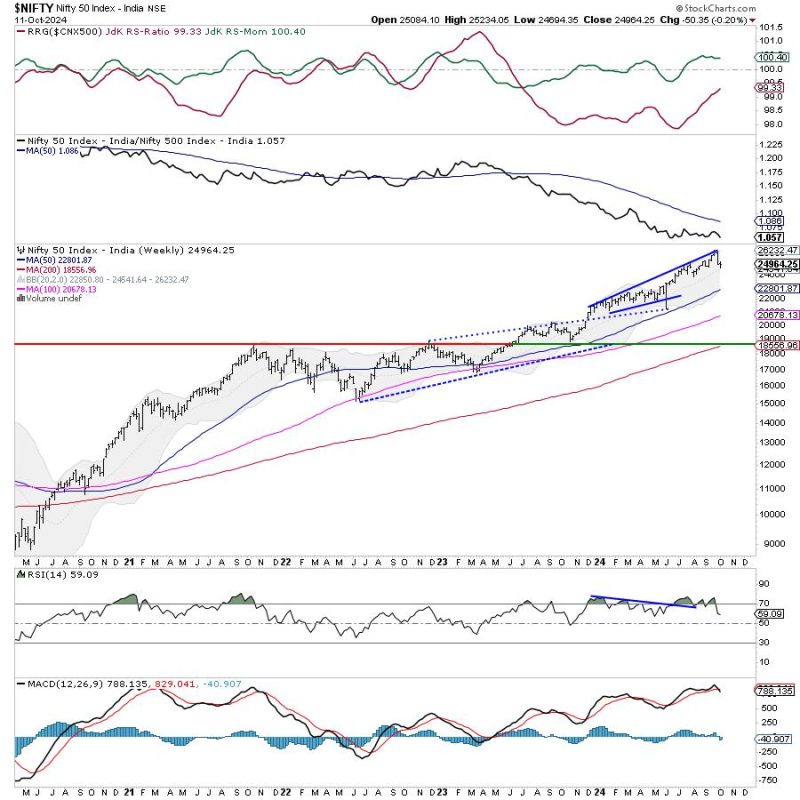

One of the crucial aspects to watch is the Nifty index consolidation. This period of consolidation can provide valuable opportunities for traders and investors alike. By closely monitoring the Nifty levels, one can gauge the market sentiment and potential directions for various assets.

Additionally, it is essential to keep a close watch on critical support and resistance levels. These levels act as important markers for determining potential entry and exit points for trades. By setting stop-loss orders and profit targets based on these levels, investors can manage their risk effectively and improve their overall trading strategies.

Moreover, understanding market dynamics and key technical indicators can further enhance your trading decisions. By analyzing moving averages, volume trends, and other technical signals, one can gain a deeper insight into market movements and potential opportunities.

Another important factor to consider is the impact of global events and economic indicators on the market. Keeping track of major news releases, geopolitical developments, and economic data can help investors anticipate market reactions and adjust their strategies accordingly.

In conclusion, staying informed and vigilant in monitoring key levels and trends is essential for successful investing. By focusing on Nifty consolidation, critical support and resistance levels, technical indicators, and global events, investors can make well-informed decisions and navigate the market with confidence. Embracing a proactive approach to market analysis can lead to improved trading outcomes and long-term financial success.