Biotechnology companies have long been considered the vanguards of scientific innovation, pushing the boundaries of human knowledge and capabilities. These companies invest heavily in research and development with the aim of discovering groundbreaking treatments and therapies to improve global health. However, recent developments have cast a shadow over the biotech sector, raising concerns about the sustainability of their endeavors.

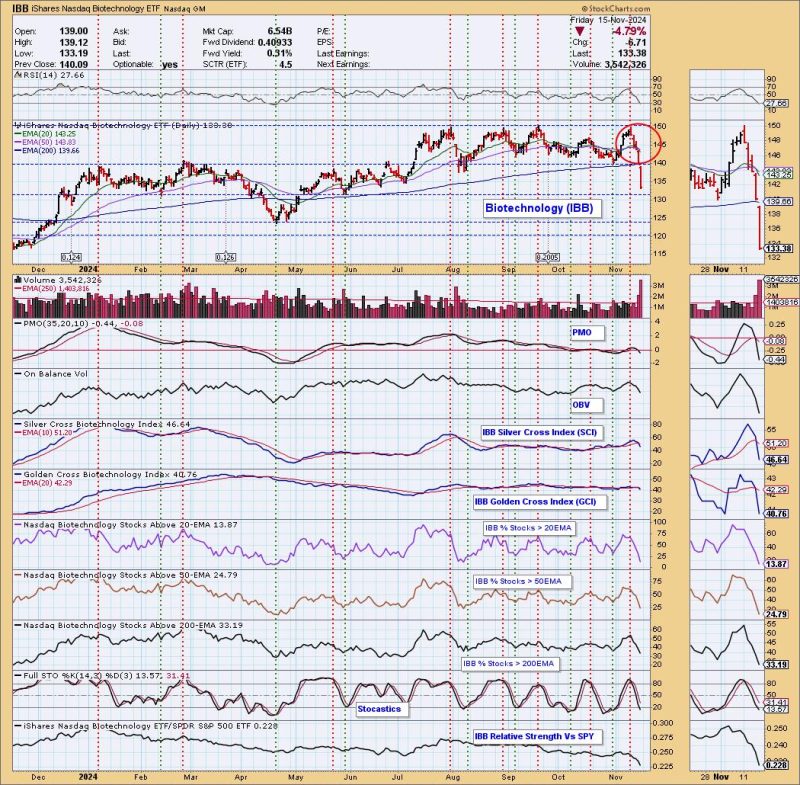

One significant development that has shaken the biotech industry is the emergence of the dark cross neutral signal. This signal, a technical analysis tool used in stock trading, indicates a bearish trend in a company’s stock price and is typically viewed as a warning sign by investors. For biotech companies, a dark cross neutral signal can be particularly damaging, as their stock prices are often tied closely to the success or failure of their clinical trials and research outcomes.

The impact of a dark cross neutral signal on a biotech company is multifaceted. Firstly, it can erode investor confidence, leading to a sell-off of shares and a decline in the company’s market value. This, in turn, may limit the company’s ability to raise capital for its research and development activities, hindering its progress in bringing new treatments to the market.

Moreover, a dark cross neutral signal can also have implications for the company’s research pipeline. Biotech companies rely on a steady stream of promising candidates in various stages of development to fuel their growth and demonstrate their potential to investors. A decline in stock price triggered by a dark cross neutral signal may force the company to reassess its research priorities, potentially leading to the shelving of promising projects or a shift towards safer, less innovative endeavors.

The implications of the dark cross neutral signal extend beyond the individual companies to the broader biotech ecosystem. Biotech startups, which often depend on larger companies for funding and partnerships, may find themselves at a disadvantage if the industry as a whole is perceived as risky or unstable. This could stifle innovation and limit the flow of new ideas and technologies into the market, ultimately slowing down progress in the field of biotechnology.

In response to the challenges posed by the dark cross neutral signal, biotech companies must focus on maintaining transparency and communication with investors. By providing regular updates on their research progress and clinical trial outcomes, companies can help investors better understand the underlying factors driving their stock prices and alleviate concerns about the sustainability of their business models.

Additionally, biotech companies should prioritize diversification in their research portfolios to mitigate the impact of any single setback or negative signal. By spreading their resources across a range of projects with varying degrees of risk and potential reward, companies can create a more stable foundation for their future growth and withstand fluctuations in the market more effectively.

In conclusion, while the dark cross neutral signal poses challenges for the biotech industry, it also provides an opportunity for companies to reevaluate their strategies and strengthen their resilience. By maintaining transparency, diversifying their research portfolios, and staying focused on their long-term goals, biotech companies can navigate the uncertainties of the market and continue to drive innovation in the field of healthcare.