In recent times, the stock market has been witnessing a prolonged period of secular bull market characterized by a consistent upward trend in stock prices. This continued momentum has been largely driven by factors like strong economic growth, low interest rates, and ample liquidity. However, amidst this overall positive outlook, there have been intriguing developments in the form of major rotations within the market, resulting in shifts in investor preferences and sector performances.

One significant trend that has emerged during this period is the rotation from growth stocks to value stocks. Growth stocks are usually companies that have shown rapid revenue and earnings growth, often trading at high multiples, while value stocks are typically seen as undervalued in relation to their fundamentals. This recent rotation indicates a change in investor sentiment towards favoring companies with more stable earnings and attractive valuations, as opposed to the high-growth but potentially overvalued stocks that were previously in vogue.

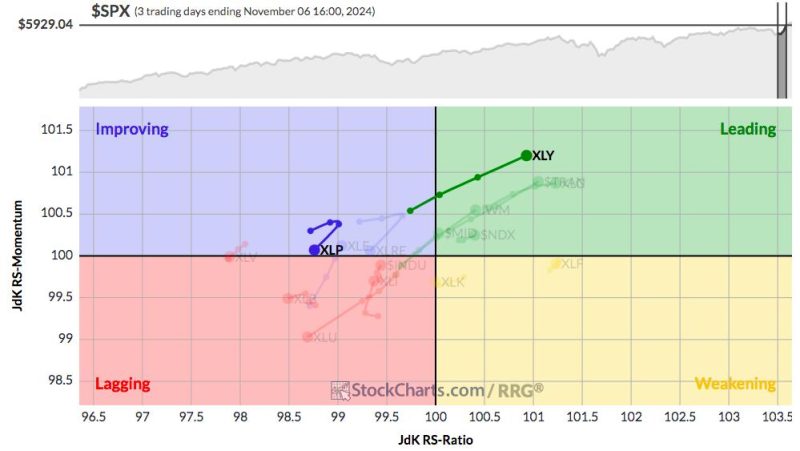

Another noteworthy rotation within the market has been the shift from technology and growth-oriented sectors towards more cyclical and value-oriented sectors like energy, financials, and industrials. This change in sector preferences reflects investors’ expectations of an economic recovery and a return to normalcy post the pandemic-induced disruptions. As a result, industries that were previously lagging behind are now gaining traction as investors seek opportunities in sectors poised to benefit from the economic rebound.

Furthermore, the rotation in market leadership has also brought about changes in market dynamics, with smaller companies outperforming larger ones and value outperforming growth. This shift highlights the importance of diversification within investment portfolios to adapt to changing market conditions and capitalize on emerging opportunities across different market segments.

It is essential for investors to stay vigilant and adapt to these rotations in the market to make informed investment decisions. Diversification, both in terms of asset classes and sectors, can help mitigate risks associated with sudden shifts in market sentiment and ensure a well-rounded investment portfolio that can weather various market conditions.

In conclusion, the ongoing secular bull market presents both opportunities and challenges for investors, with major rotations reshaping the market landscape. By staying informed, maintaining a diversified portfolio, and focusing on sectors and companies with strong fundamentals, investors can navigate these market rotations effectively and position themselves for long-term success in an ever-evolving investment landscape.