Investing in Chromium Stocks: A Comprehensive Guide

Understanding Chromium and Its Market

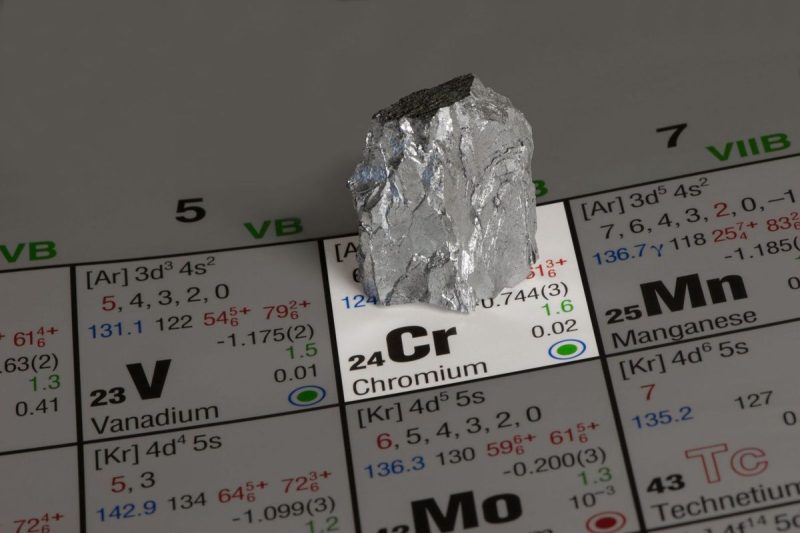

Chromium is a versatile rare metal that plays a vital role in various industries, including stainless steel production, aerospace, and automotive manufacturing. With its increasing demand driven by industrial growth and technological advancements, investing in chromium stocks can be a lucrative opportunity for investors seeking exposure to the metals sector.

Factors Influencing Chromium Prices

Several factors influence the price of chromium, making it essential for investors to understand the market dynamics before investing in chromium stocks. The main factors affecting chromium prices include global supply and demand dynamics, geopolitical factors, currency fluctuations, and market speculation. By keeping a close eye on these factors, investors can make informed decisions regarding their chromium investments.

Key Players in the Chromium Market

When considering investing in chromium stocks, it is crucial to research and identify the key players in the chromium market. Companies like Glencore, Eurasian Resources Group, and Samancor Chrome are some of the major players in the chromium industry, involved in exploration, mining, and production of chromium products. Analyzing the performance and growth prospects of these companies can help investors make strategic investment decisions.

Technical Analysis of Chromium Stocks

Conducting technical analysis on chromium stocks is essential for investors to identify potential entry and exit points. By analyzing historical price data, trends, and trading volumes, investors can gauge the market sentiment and make more informed investment decisions. Utilizing technical indicators such as moving averages, MACD, and RSI can provide valuable insights into the short-term price movements of chromium stocks.

Diversification and Risk Management

As with any investment, diversification and risk management are key elements to consider when investing in chromium stocks. Diversifying across multiple chromium stocks or allocating a portion of the investment portfolio to other sectors can help mitigate the risks associated with investing in a single commodity. Implementing risk management strategies, such as setting stop-loss orders and having a clear investment plan, can also help protect investors from potential losses.

Long-Term Outlook for Chromium Investments

Investing in chromium stocks can offer promising returns for investors with a long-term outlook. As the global demand for chromium continues to rise, driven by the growing industrial and technological sectors, investing in chromium stocks can be a strategic way to capitalize on this trend. By keeping abreast of market developments and maintaining a diversified portfolio, investors can position themselves for long-term success in the chromium market.

In conclusion, investing in chromium stocks can be a lucrative opportunity for investors seeking exposure to the metals sector. By understanding the market dynamics, researching key players, conducting technical analysis, and implementing proper risk management strategies, investors can make informed decisions and capitalize on the long-term growth prospects of chromium investments.